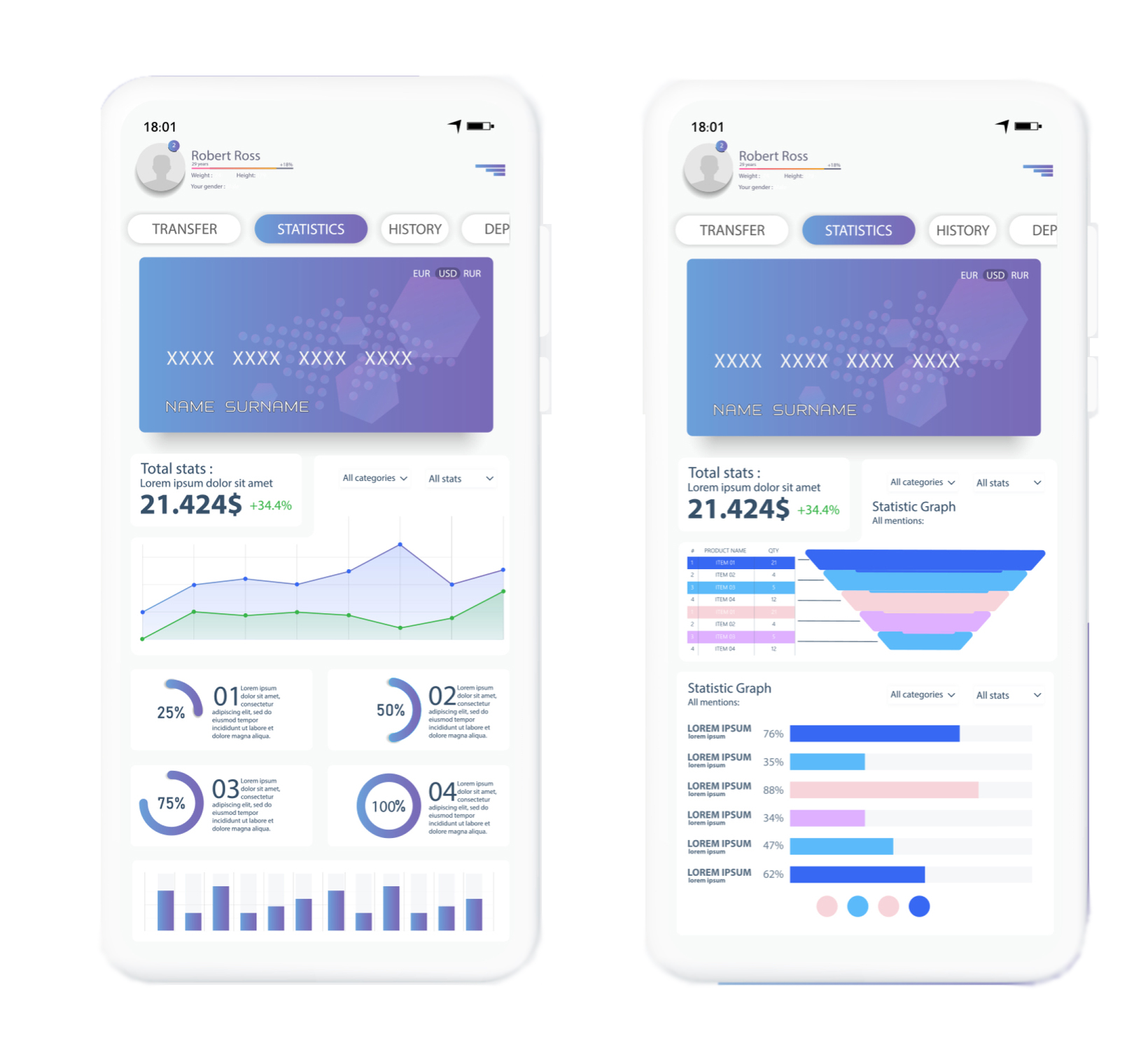

1. Earn up to 7.4% interest with a PayBitoPro crypto banking savings account. Interest is accrued on a daily basis and is paid on a monthly basis. No hidden costs. No minimum balance. Hence, no reason to wait.

2. Moreover, our crypto banking platform provides full transparency and total control over your account and assets. Therefore, the PayBitoPro App enables you to operate from any smart device.

3. PayBitoPro believes in client empowerment. Therefore, that’s precisely why we allow you the choice of cryptocurrency in which to receive interest payments. So, you take your pick from Bitcoin, Ether, or any stablecoin.

4. Moreover, we employ the latest and updated security measures and protocols to protect your data. This includes a two-factor authentication to gain access. Thus creating a secure ambiance for your assets to accrue interest.

1. Payments- IN/OUT USD, INR, AED, SGD

2. At PayBitoPro crypto banking, we work to hasten the process of conversion from fiat to cryptocurrency.

3. Thereafter, senders and recipients get notified of the benefits of settlement within seconds of transfer.

4. Moreover, our processing fees are the least, compared to other payment methods prevalent in the industry.

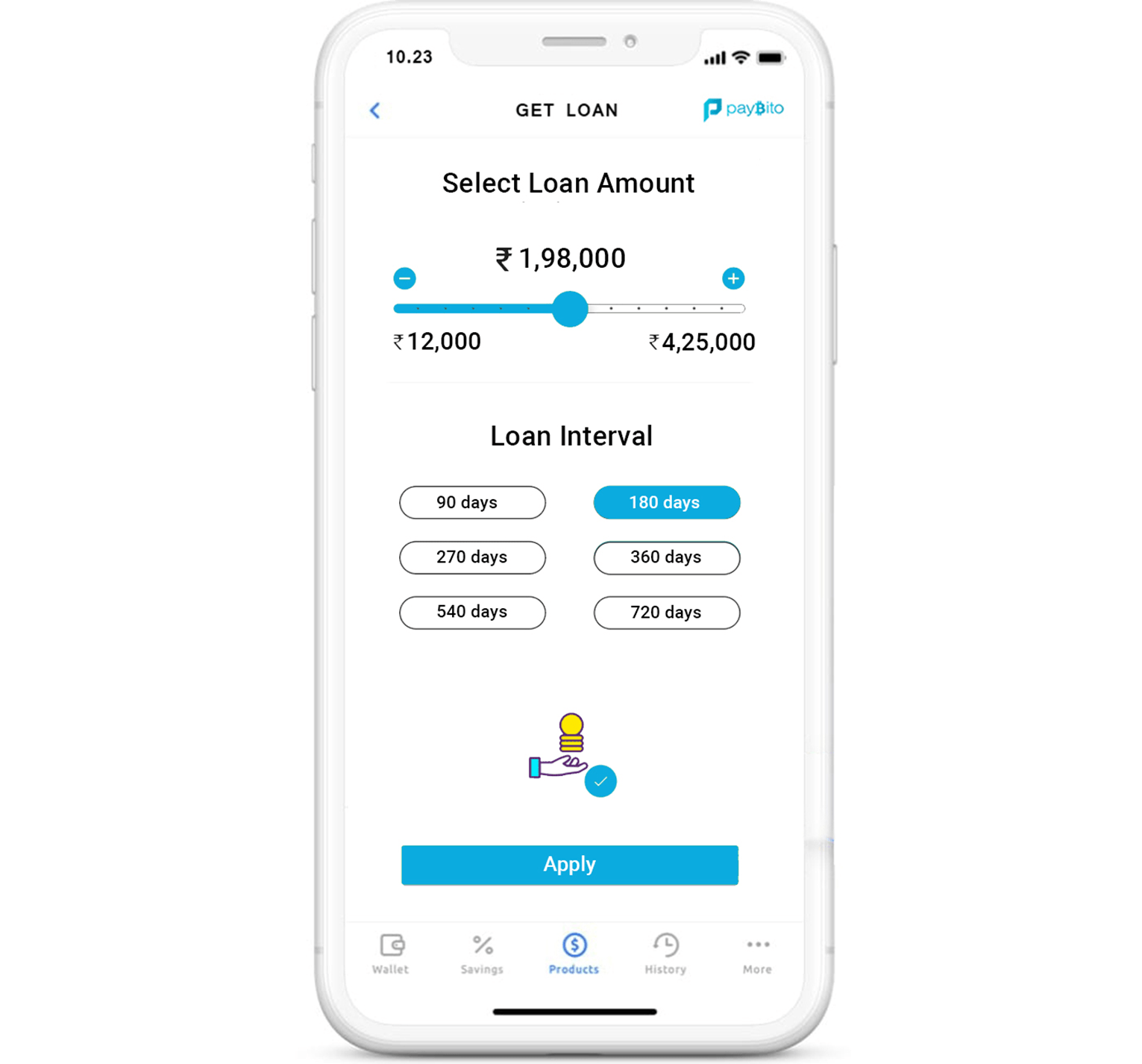

1. In PayBitoPro, the Bitcoin (BTC) in your account acts as collateral against the loan. Therefore, when an individual opts for a loan, the amount in BTC is transacts from your BTC wallet to a collateral wallet which will now hold your BTC. Moreover, BTC collateral can only be withdrawn from your collateral wallet once the loan is repaid, which can be made over the following 12 months.

2. However, only Bitcoins, are accepted as collateral against the loan. No other cryptocurrency qualifies to be as collateral.

3. Moreover, users with loan health featuring above 70%, may avail of the option of withdrawing the excess collateral back into their BTC wallets or using those to borrow additional amounts towards yet another loan.

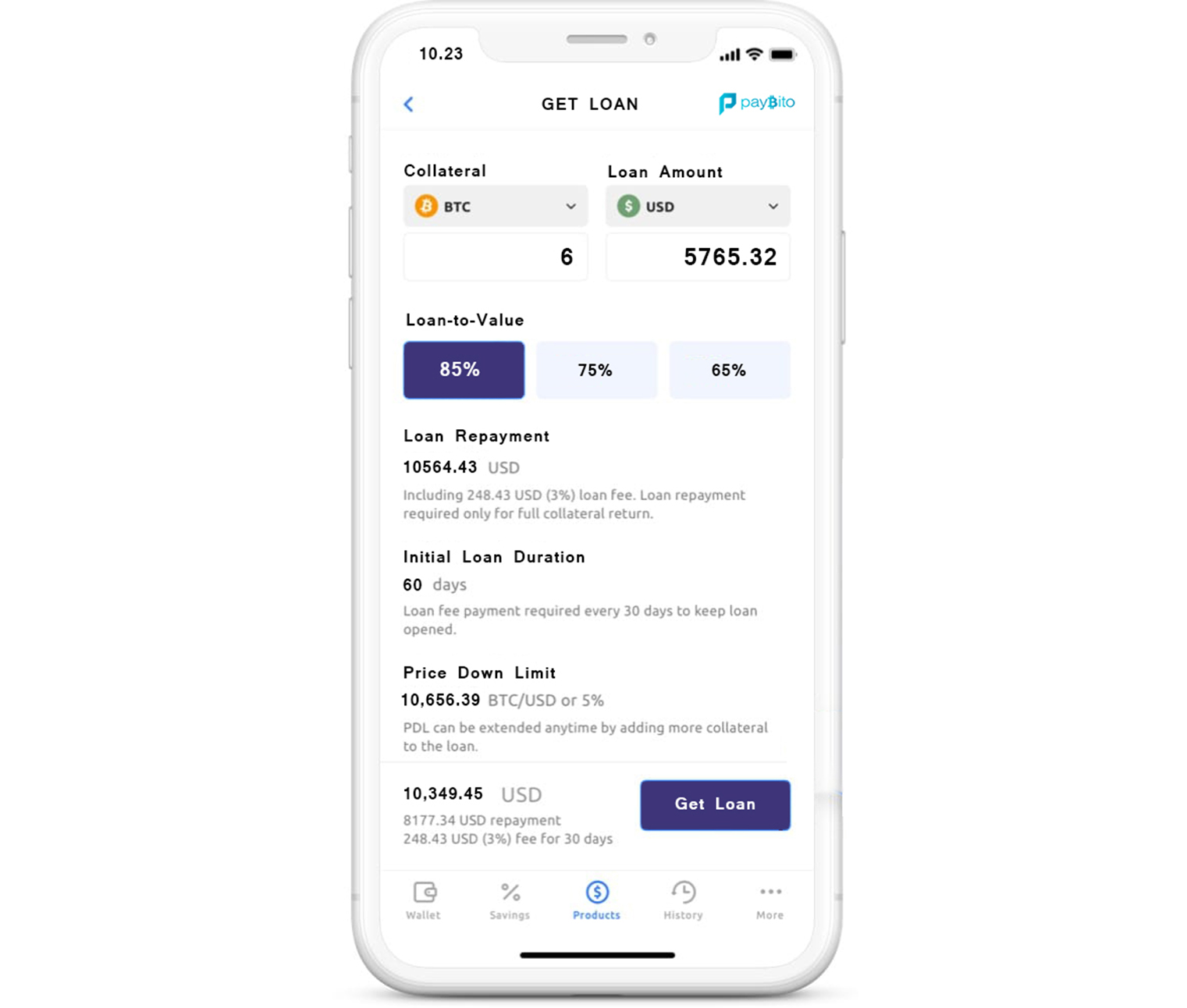

1. PayBitoPro's crypto banking offer to loan several cryptocurrencies and act as collateral.

2. Moreover, we maintain risk control procedures through various collateral rates in distinct currencies for ease of use.

3. Furthermore, we ensure the immediate withdrawal of your borrowed crypto, irrespective of your location.

Step 1. The borrower raises a request for a loan

Step 2. Move borrower’s Collateral Assets to PayBitoPro’s platform

Step 3. PayBitoPro approves Borrower’s request.

Step 4. The rate of Interest is at 9.2%

Step 5. Upon full repayment of the loan with interest, PayBitoPro transacts the borrower’s crypto assets to the borrower’s wallet.