Bitcoin at 20k: Bullish Indicators

- December 8, 2020

- Jennifer Moore

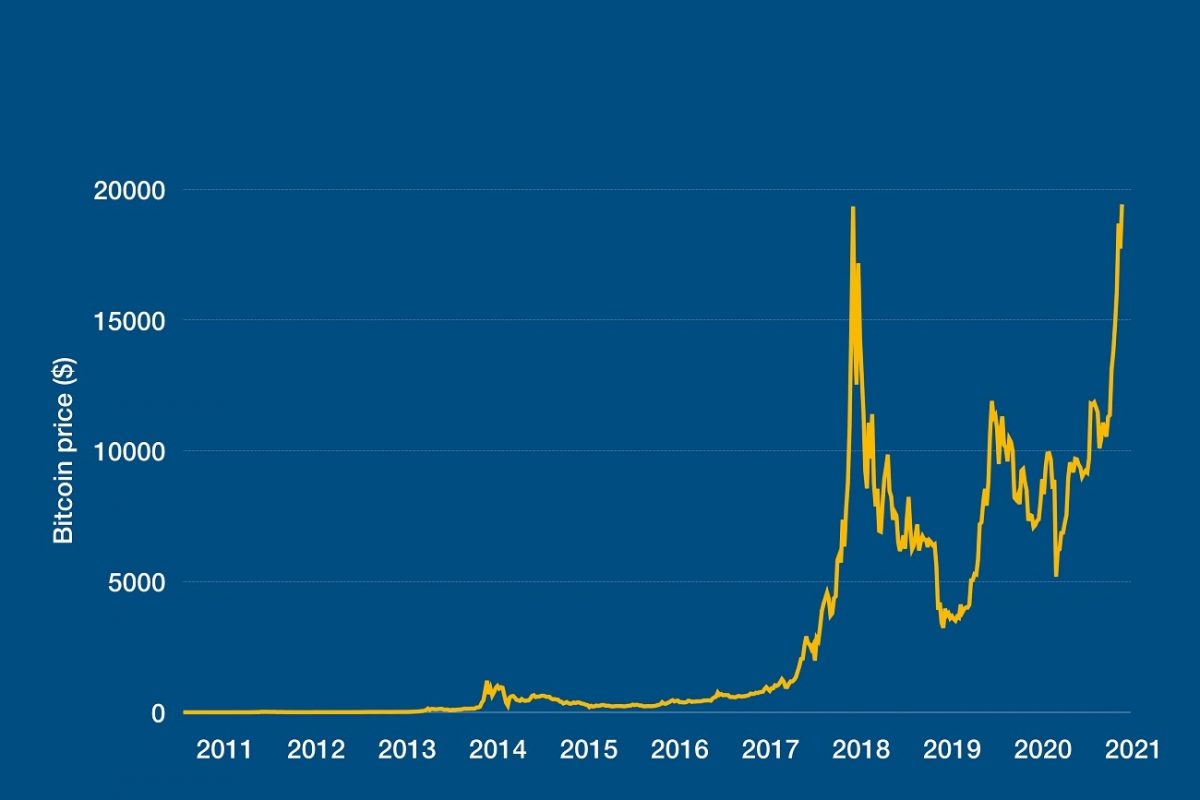

In the last few days, the Bitcoin price has been inching closer to the 20,000 USD mark, but not quite surpassing it. This has caused, some traders to lose patience over the problems due to the lack of bullish momentum considering that the crypto tested around 16,200 USD just a week before that. The seasoned traders however are well acquainted with the signs of a trend reversal in market activity. They are focussing on the volumes, futures premium, and top positions at all major exchanges. With market experts predicting a bullish run, here are a few factors that are influencing Bitcoin’s rally.

The Futures Premiums Bitcoin

There are trading indicators that show the long-to-short ratio of multiple assets, however, in reality, those are just a comparison between the bids volume and stacked offers. The best way to understand the rally of Bitcoin is to monitor the perpetual futures premium and funding rate.

The open interest of traders of perpetual contracts bitcoin is matched in a futures contract at all times. There is no way that any imbalance will take place, as the requirement of both long and short for each trade is mandatory. The funding rates guarantee that there will be zero exchange risk imbalances. In the event that the sellers (shorts) are demanding increased leverage, the funding rate becomes negative, making only those traders eligible for fee payment.

Sudden shifts felt in the negative price range indicate a willingness of the market to keep shorts open. Investors usually monitor a few crypto exchanges so that they can avoid any eventual anomalies.

Also Read: Bitcoin’s Price Surges to an All-Time New High, Attracting New Investors in the Market

The funding rate may bring certain distortions being the preferred avenue for retail traders that causes impact by excess leverage. It is the professional traders that usually dominate the long-term futures contracts but with a set expiration date. A trader can assess the level of bullishness by measuring the expense differentiation between futures and the regular spot market.

Exchange Volume Monitoring

Some traders are also known to track the volume of the spot market. Breaking the important resistance levels on the low volumes can be intriguing. It is usually the low volumes that indicate a lack of trading confidence. Hence, the significant price fluctuations must be accompanied by a robust trading volume. While the recent trading volumes have remained above the average level, the traders should be skeptical of the price swings below $3 billion in regular volume, in a 30-day time frame.

Leading Trading Exchanges

Another key factor is monitoring the Bitcoin top traders’ long-to-short ratio, available at the leading exchanges. Considering the frequent discrepancies in the exchange methodologies, one should monitor the changes instead of the absolute figures. A sudden shift in the long-to-short ratio is a troubling signal. However, the ratio can differ between exchanges, and this effect can be neutralized through avoidance of direct comparisons.

Also Read: The Growing Popularity of Crypto Derivatives Trading

There is no definite rule for predicting large dips, considering the requirement of multiple indicators turning bearish before entering the short positions or closure of the long positions.

Bitcoin Rally Difference This Time

A lot has significantly changed in the crypto industry, especially if compared to the 2017 bullish run considering the improved infrastructure that has developed over the years. At present, there are regulatory derivatives provided via CME and CBOE futures contracts. Along with that, the rapid growth of institutional investors is also offering an unending source of BTC demand.

A host of new multi-billion-dollar-market-cap Bitcoin decentralized finance platforms have also emerged. It supports a new infrastructure of lending, synthetic swaps, and interest-earning for a diverse set of new investors.

The retail-driven flow is likely to push some altcoins higher with the addition of real use cases. That has emerged over the years. Considering the increase in crypto usage in 2020, the trades are likely to see a boost in interest including decentralized exchange tokens, oracles, non-custodial lending, interconnectivity, and liquidity provision.

Categories

- AI (6)

- Altcoins (10)

- Banking (10)

- Bitcoin (133)

- Bitcoin ETF (11)

- Bitcoin Price (30)

- Blockchain (47)

- Brokering World Hunger Away (16)

- Business (8)

- CBDC (11)

- COVID-19 (3)

- Crypto ATMs (1)

- Crypto Banking (15)

- Crypto Bill (1)

- Crypto broker platform (26)

- Crypto Investment (3)

- Crypto Markets (3)

- Crypto Payment (27)

- Crypto Prices (1)

- Crypto Trading (89)

- Cryptocurrency (371)

- Cryptocurrency Exchange (103)

- Data Visualization (2)

- Decentralized Finance (7)

- DeFi Payment (9)

- DEX (3)

- Digital Currency (22)

- Ethereum (2)

- FAQ (6)

- Finance (24)

- Financial Equality (4)

- Financial Freedom (8)

- Forex (24)

- ICO (1)

- Investment (11)

- Mining (3)

- News (66)

- NFTs (2)

- P2P (1)

- PayBitoPro (627)

- PayBitoPro Coin Listing (6)

- PayBitoPro Exchange (2)

- Post COVID Digital Transformation (1)

- Press Release (130)

- Privacy & Security (3)

- Real Estate (1)

- Stablecoin (4)

- Technology (14)

- Uncategorized (3)

- US Presidential Election (2)

- Utility Coin (1)

- Web3 Wallets (1)

- White Label Crypto Broker Solution (1)

- White Label Crypto Exchange (6)

Recent Posts

- The Affiliate Business Model Is Highly Beneficial For New Users

- Online Income Sources Are Becoming A Preferable Choice For Many

- The Bright Future of Crypto Merchant Payment Business

- How to Have a Lucrative Side Hustle Through a Crypto Exchange?

- Key Factors To Consider For A Successful Crypto Trading Experience