Can Crypto Be a Game-Changer For the Cannabis Industry?

- September 21, 2022

- Jennifer Moore

Cryptocurrency has been taken as an elixir for solving the global cannabis industry problems related to banking and financial operations. Cannabis is legal in many countries mainly for medicinal and developmental uses. However, it is still illegal under federal regulations. Several cannabis enterprises are blacklisted by credit card networks. Moreover, federal banks are coercing them to cache cash on-site. However, this has made them vulnerable to brutal burglary, and payment of extra money to banks. In this article, we will look into the index of cannabis adoption in different countries and the number of users to understand its potential. We will also evaluate the potential of cryptocurrencies and NFTs to solve the problems of the marijuana industry.

Table of Contents

Cryptocurrencies: Can it Help to Resolve the Issues in the Cannabis Industry?

The Global Cannabis Market: What You Need to Know?

Cannabis Users Statistics Around the World

Silk Road: The First to Use Bitcoin to Buy and Sell Marijuana

GCC Plans to Develop 100,000 Tokens

Crypto Cannabis Club: A NFT Community for Stoners

North America Dominating the Market Since 2020

Crypto & Cannabis: But, What About Tax?

The SAFE Banking Act

Blockchain to Help With Supply Chain Management

Bottomline

Cryptocurrencies: Can it Help to Resolve the Issues in the Cannabis Industry?

Cryptocurrencies have evolved over the years, and with the global adoption of the currency, the cannabis industry is considering it to be a natural solution to its banking problems. Cannabis enterprises can incorporate the technology and accept crypto payments instead of cash. This will help them to keep the cryptocurrencies in their crypto wallets rather than piling up the cash which has been an open invitation to robbers for years.

The problem lies in the very nature of cryptocurrencies, which is their “volatility”. The high transaction costs and the market volatility can become more of a poor choice for the cannabis businesses to take the trouble of setting up a crypto payment gateway and learning its functions. Other than these problems, it is also important to remain exempt from the regulations. A similar situation forced a global cryptocurrency company in 2018 to shut down a medical marijuana dispensary account based in Washington due to the restrictions imposed by federal laws.

Also Read: Worldwide Crypto Adoption Index 2022

The Global Cannabis Market: What You Need to Know?

The market size of the cannabis industry worldwide in 2020 was $20.47 billion. The industry is estimated to observe a rise in the market size from $29 billion to $35.4 billion in 2022. According to the market research experts of HashCash Consultants, the cannabis industry might grow at a CAGR of 11.2% between 2022 and 2027 and is assumed to reach $57 billion by 2027. The sudden growth is due to the growing demand of the market, especially post-pandemic. Cannabis has existed since ancient times, almost over a thousand years with its consumption based on acknowledgment and affirmed medicinal and healing advantages. C. Indica, Sativa, and ruderalis are the three main species of cannabis. With that, marijuana is legalized in several countries around the globe.

According to the UNODC, (United Nations Office on Drugs and Crime), Cannabis is the most widely trafficked, cultivated, and consumed drug around the globe. Weedmap’s survey, suggests that ever since the global covid 19 pandemic, 50% of cannabis users have increased their consumption rates. The weeds are no longer confined to men. According to 2022 research conducted by Eaze, there has been a rise in new customers, with 52% of them being men, and 48% of them female. Although in many countries, marijuana is still illegal, the United States has made rapid progress and made recreational cannabis legal access to almost 44% of Americans. Research conducted by Gallup shows, that 19% of the population born before 1945, have tried marijuana, while 49% of GenX, 50% of Baby Boomers, and 51% of millennials inform that they have tried cannabis.

Cannabis Users Statistics Around the World

Amidst the legislation on cannabis, apart from the recreational use of the product, the cerebrovascular effects are unknown, especially in young adults. Here is a survey conducted on behavioral risk factors.

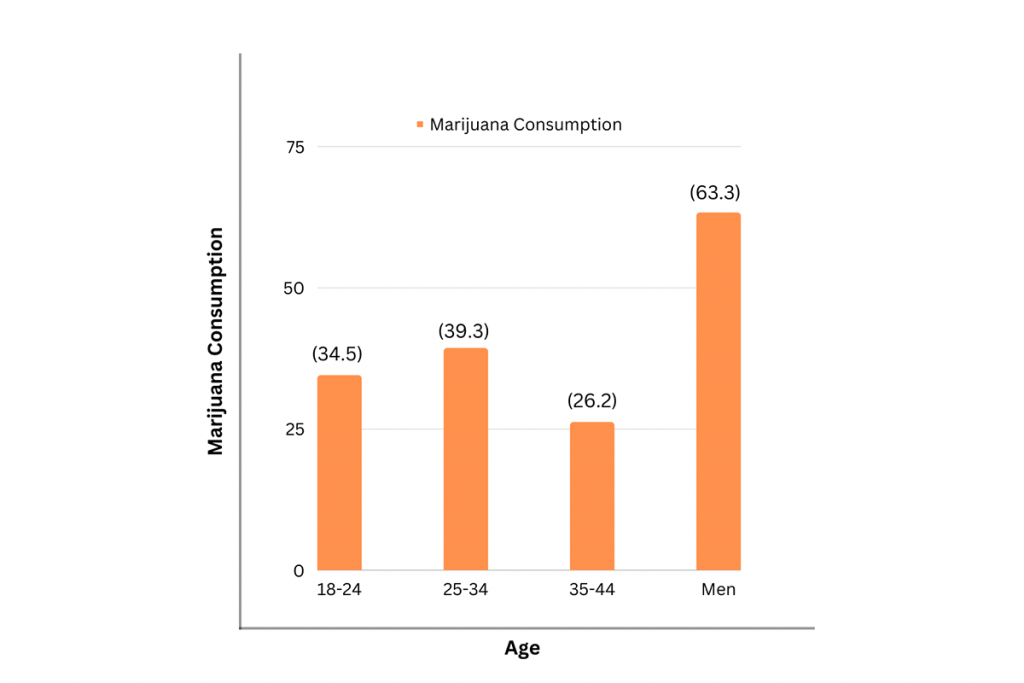

Age:

Marijuana is consumed by several age groups between 18 to 44. Here is the report of a survey conducted among different age groups to check its consumption rate.

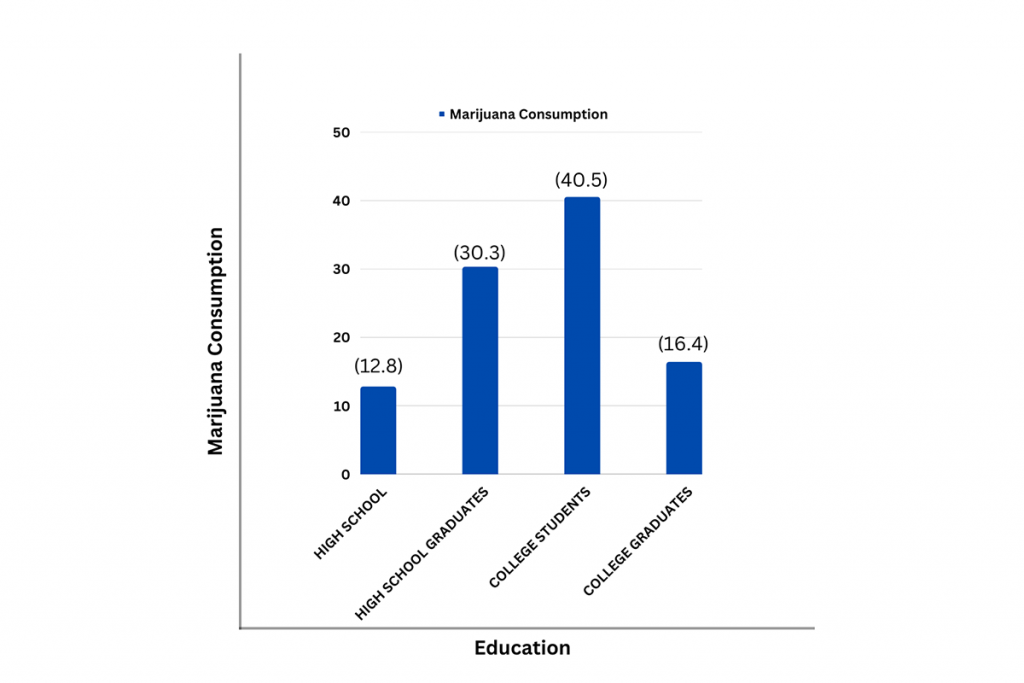

Education:

The survey on marijuana consumption is divided into different categories. The users are segmented into the education sector as high school students, high school graduates, college students, and college graduates.

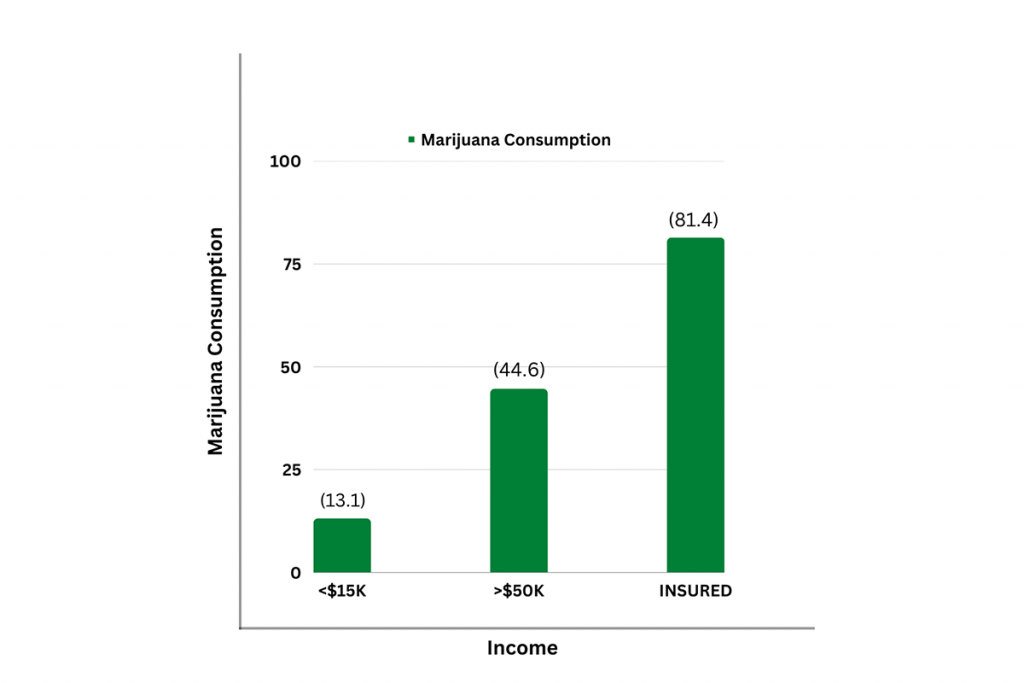

Income:

This segment consists of marijuana consumers depending on their income status, and the well-settled insured users.

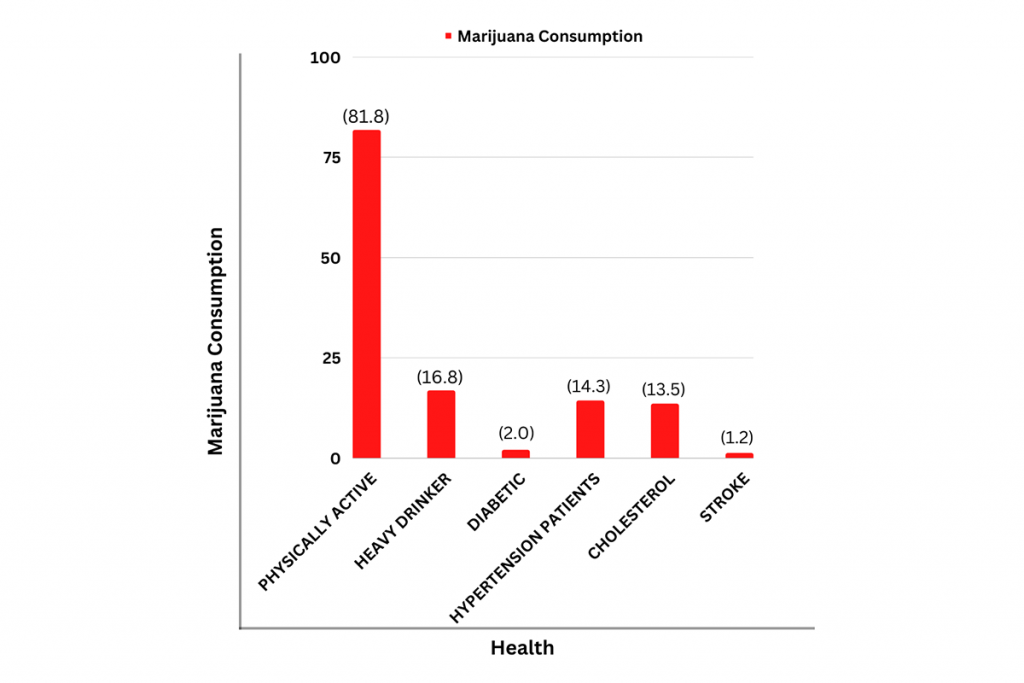

Health:

Marijuana has side effects on the cerebrovascular front. Although it’s still unknown. Here is a survey on a few health diseases mentioned below.

Silk Road: The First to Use Bitcoin to Buy and Sell Marijuana

The crypto industry and the cannabis sector merged in the very first modern darkest network, known as Silk Route, founded by “Ross Ulbricht”, also known as “Dread Pirate Roberts”. In 2013, the FBI shut down the Silk Route that allowed users to buy and sell marijuana which was at the period illegal in several states.

Last month, Democratic Sens. Cory Brooker and Senate Majority Leader Chuck Schumer, and Ron Wyden of Oregon created the Cannabis Administration & Opportunity Act which would eliminate cannabis from the Cannabis Substances Act, eliminate any arrests, and convictions for nonviolent cannabis federal offenses and introduce a basic tax on the cannabis products.

GCC Plans to Develop 100,000 Tokens

Since cannabis is illegal in several countries, it is very difficult to raise investment and make it grow. However, a Luxembourg enterprise based in Latin America has found a noble solution to the problem.

According to Bloomberg, the GCC or Global Cannabis Capital is planning to raise more capital. The report also shared that the company is planning to sell tokens on the Ethereum blockchain that show its equity rather than the conventional IPO. While GCC originally planned for a reverse public offering in Canada that is marijuana friendly, the company ended up looking into options and is now aiming to offer 100,000 security tokens.

The process will occur in Luxembourg as the regulations are favorable toward cannabis and with the idea of protecting the products with blockchain technology. The token offering will help the enterprise to enlarge its sources of funding available for the pot industry that cannot lend money from banks as it is illegal at the federal level. Therefore, funding is mainly from venture capital and other sources like individual shareholders, and wealthy individuals.

Crypto Cannabis Club: A NFT Community for Stoners

On a night in Los Angeles, a group of strangers assembled at a colorful smoky venue. The majority of these people were meeting each other for the first time while some were old friends calling each other weird names. The gathering was to celebrate the launch of Crypto Cannabis Club’s metaverse dispensary. The CEO of Crypto Cannabis Club, Ryan Hunter says that “even during the crypto bear market, the club is unperturbed taking up NFTs”.

The club consists of six thousand members and each has to acquire a “toker” which is a bright-colored stone-looking character NFT that helps the users to take advantage of its benefits which include events. The basic price of a toker is around 0.15 ETH, which is around three hundred dollars. The cost of NFTs dipped last week with its lowest reaching around 0.1 ETH. However, it has bounced back up to 50% ever since.

Crypto Cannabis Club

The founders of the club, Jima and Kevin Fitzpatrick worked with the cannabis industry for a decade before entering the crypto space two years ago. Within 7 days, the entire collection was out. That too with the lowest tokers selling at 0.8 ETH. This is roughly two hundred to two hundred and fifty dollars. Today, the group has twenty-three thousand subscribers and twenty-eight chapters around the world. Some of the high-profile members of the group are Tommy Chong, Cookies CEO Berner, Cheech Marin, and rappers Lil Baby, and Ja Rule.

The crypto cannabis club has been existing for a year yet the group has been conducting several activities. Within a year, the company has hosted five events and meetings that include business conventions such as Art Basel, a trip to Mexico with members, and MJBIZCON. The club is planning to host more events and is jointly working with several cannabis brands and make it available in several states. These groups will help the club to survive the crypto winter.

Hunter once developed a ten-acre cannabis farm and shared his vision to provide a community that can share both virtual and real-life experiences. The NFT social club has a virtual dispensary in Voxels Metaverse and has partnered with thirty cannabis accessories and product providers to prepare a utility program that offers discounts for the members of the Crypto Cannabis Club.

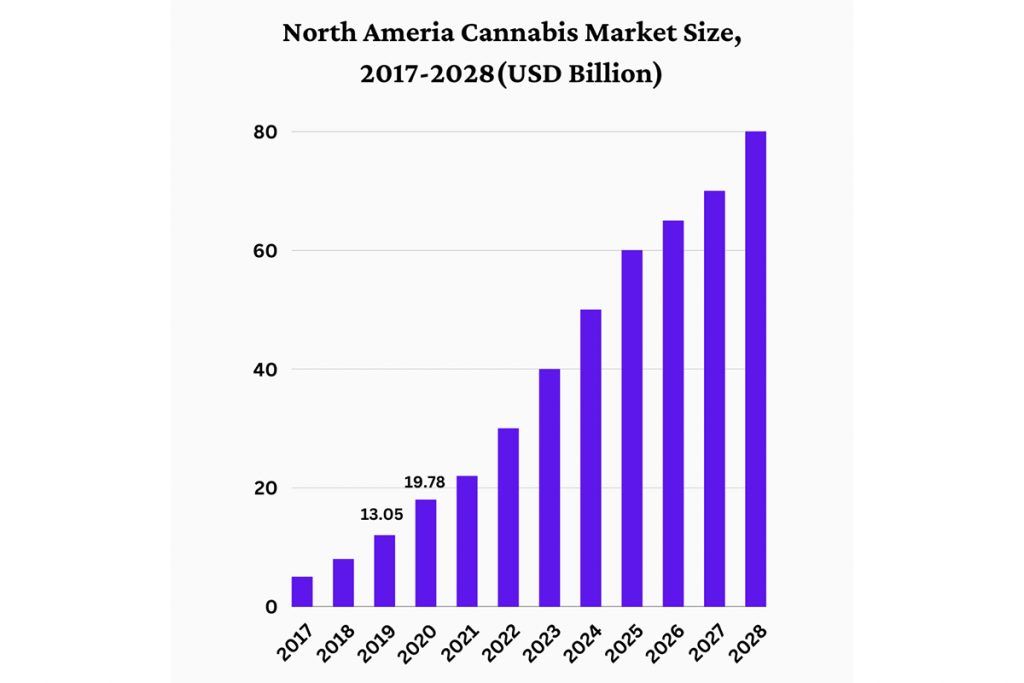

North America Dominating the Market Since 2020

North America dominated the cannabis market in 2020. It was at a value of $19.78 billion. The recreational legislation in the United States started in 2012 with Washington and Colorado becoming the first two states to make the recreational use of cannabis legal.

In 2019, 11 states and the Columbian district legalized cannabis for recreational purposes. In the United States, all the state medical hemp laws have considered it as a type of medicine for diseases like anorexia, chronic pain, arthritis, Alzheimer’s disease, post-traumatic stress disorder, epilepsy, and even cancer. By being the leader of the worldwide marijuana laws, Canada has been the frontrunner in the industry.

The second largest market that is responsible for the growth of the use of medicinal cannabis and under the legislation in Europe. In European countries, cannabis is famous for medical treatments. Moreover, it treats health conditions such as cancer, AIDS syndromes, and appetite stimulus. Moreover, the products are rapidly increasing with the changes in government policies. In 2018, the governments of Greece and the United Kingdom approved the use of medical marijuana.

Crypto & Cannabis: But, What About Tax?

The lack of bank access issue in the cannabis industry is real and well-known. However, it is still not the worst problem for the industry. The professor at the University of California, Bob Solomon, and the co-chairman of UCI Center, Irvine for the cannabis study shares with a worldwide research firm. Not banking, but the tax burden will be the main issue for the cannabis industry.

Since cannabis is federally illegal, the industry falls under Section 280E of tax policy. Therefore, the cannabis business needs to pay tax without deducing the basic expenses, which makes minimum profit margins. This means that the companies need to pay a 70% tax rate. Usually, the corporate business tax rate is only 20%.

The owner of Fortis Law Partners, shares that many people invest in cannabis thinking that they will earn money. However, they do not consider the taxes. Moreover, the small profit margin which is why many fail to carry forward their business. These taxes are unlimited for businesses. However, also affects the consumers including the local surcharges. Thereby, making it difficult for the legal dispensaries to stand out in the competition with the black market.

The SAFE Banking Act

The SAFE Banking Act can resolve the basic problems of the cannabis industry. By making banks help the industries that provide their banking services to legal businesses. That without the fear of committing federal crimes.

While some cannabis businesses are paying around two thousand dollars a month just for having a bank account. Others are still figuring out a way to save themselves from paying high taxes. Although the SAFE Banking Act is not a solution for the cannabis industry. Yet it is still a better approach than introducing cryptos and NFTs.

Blockchain to Help With Supply Chain Management

Cryptocurrency may not be the solution to all the problems related to the cannabis industry. The CEO of Safe Harbor Financial, Sundie Seefried is providing banking solutions to the cannabis industry since 2015. Moreover, processed around fourteen billion dollars.

Blockchain technology in the cannabis industry can revolutionize the way the industry works due to its power of traceability. At present, Safe Harbor relies on different sources to keep track of the cannabis products which is at high risk.

The city council member of Berkeley California, Ben Bartlett who is a crypto lawyer by profession shares her views. Blockchain technology can help cannabis businesses with compliant supply chains. Thereby, tracking ownership and providing provenance.

Bottomline

At first, the emerging cryptocurrency market, and the legalized marijuana business might seem unmatched. However, if you look closely, there is a harmonious environment between the two. Cannabis companies struggle to access even basic financial services that can greatly benefit from digital assets like Ethereum and Bitcoin. However, the implementation of blockchain technology can help optimize the overall business. Along with transparency and traceability in areas where the mechanism is quite complex. While crypto can be a great idea to generate funds, its volatile nature may put the entire industry at risk.

Categories

- AI (6)

- Altcoins (10)

- Banking (10)

- Bitcoin (133)

- Bitcoin ETF (11)

- Bitcoin Price (30)

- Blockchain (47)

- Brokering World Hunger Away (16)

- Business (8)

- CBDC (11)

- COVID-19 (3)

- Crypto ATMs (1)

- Crypto Banking (15)

- Crypto Bill (1)

- Crypto broker platform (26)

- Crypto Investment (3)

- Crypto Markets (3)

- Crypto Payment (28)

- Crypto Prices (1)

- Crypto Trading (91)

- Cryptocurrency (376)

- Cryptocurrency Exchange (103)

- Data Visualization (2)

- Decentralized Finance (7)

- DeFi Payment (9)

- DEX (3)

- Digital Currency (22)

- Ethereum (2)

- FAQ (6)

- Finance (24)

- Financial Equality (4)

- Financial Freedom (8)

- Forex (24)

- ICO (1)

- Investment (11)

- Mining (3)

- News (66)

- NFTs (2)

- P2P (1)

- PayBitoPro (635)

- PayBitoPro Coin Listing (6)

- PayBitoPro Exchange (2)

- Post COVID Digital Transformation (1)

- Press Release (130)

- Privacy & Security (3)

- Real Estate (1)

- Stablecoin (4)

- Technology (14)

- Uncategorized (3)

- US Presidential Election (2)

- Utility Coin (1)

- Web3 Wallets (1)

- White Label Crypto Broker Solution (1)

- White Label Crypto Exchange (6)